Learn what’s driving builders to slash prices faster than ever before.

Florida’s housing scene is taking an unexpected turn—and fast. Home builders Price Cuts are sweeping through the state like a sudden summer storm, leaving buyers wide-eyed and sellers second-guessing.

What’s behind the markdown frenzy? If you’ve been eyeing the market, now’s the time to lean in. The deals are real, the stakes are high, and the opportunity is fleeting.

A Quick Look at Why Builders Are Hitting the Panic Button

Florida’s once-sizzling new home market is cooling faster than anyone expected. Homebuilders aren’t just trimming prices—they’re chopping them. Some cuts are as steep as $50,000 or more. Behind the scenes, builders are balancing rising costs, cautious buyers, and growing competition. It’s a perfect storm pushing them into action before things spiral further.

Entire developments filled with move-in-ready homes now feature banners with big discounts, mortgage rate buydowns, and closing cost incentives. Still, many buyers are holding back. Mortgage rates are high. Inflation is stretching household budgets. People are hesitant.

Meanwhile, builders are facing mounting carrying costs: property taxes, insurance, loan interest, and upkeep. Selling quickly, even at a discount, is better than letting homes sit.

The Real Estate Rollercoaster: What’s Going On?

From Record Highs to Price Cuts—How Did We Get Here?

Just a few years ago, bidding wars and over-asking offers were the norm. Prices shot up. But, what goes up eventually balances out. Now, the pendulum is swinging back.

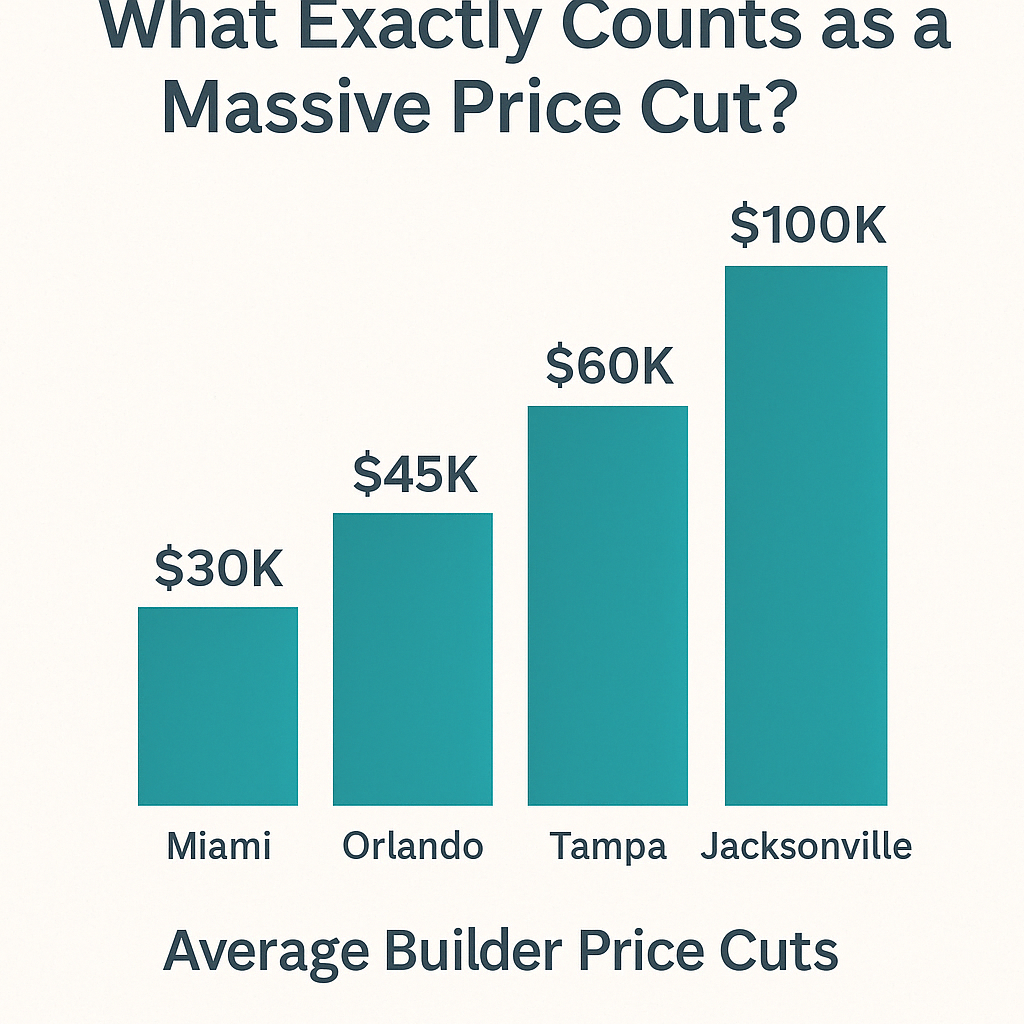

What Exactly Counts as a Massive Price Cut?

A small discount used to be $5,000. Now? Some builders are dropping $30,000, $60,000, even $100,000 off the asking price. These aren’t small tweaks—they’re major moves.

What are they offering?

- Lower base prices

- Mortgage rate buydowns

- Paid closing costs

- Free upgrades and appliance packages

This isn’t just about generosity. It’s about urgency.

The Pandemic Boom That Set the Stage

How Soaring Demand Created Today’s Oversupply

During COVID, everyone wanted space, sunshine, and change—and Florida became the hotspot. Builders raced to meet the demand. Construction soared. But the pace of buyer interest didn’t last.

Now, many of those homes are built—and sitting.

Too Much Inventory, Too Little Demand

Some new Florida neighborhoods are surprisingly quiet. Streets are lined with brand-new homes, but many are still empty. Drive through newer developments, and you’ll see it—rows of finished homes with “Price Reduced” signs. The oversupply isn’t uniform, but it’s notable in suburban areas and regions hit hardest by construction overdrive. Supply outpaced demand, and now builders are stuck holding the bag.

Why are these homes still on the market?

- Mortgage rates are high

- Buyers are cautious

- Neighborhoods lack schools, stores, or parks

Buyers are waiting. Builders are stressing. And sellers nearby may need to drop their prices just to stay in the game.

Rising Mortgage Rates Hit Buyers Hard

How Interest Rates Are Making Monthly Payments Painful

That jump from 3% to 7%? It adds hundreds of dollars to a monthly mortgage payment. Even if the home price is lower, financing costs more. For many families, it’s simply out of reach.

Inflation’s Impact on Buyer Confidence

Groceries Up, Gas Up—Housing Budgets Down

Even buyers with pre-approvals are stepping back. Everyday costs are rising. Confidence is falling. Homeownership feels riskier when basic needs already feel tight.

Builder Incentives Aren’t Working Like Before

Why Free Upgrades and Closing Costs Aren’t Cutting It Anymore

Fancy countertops and smart thermostats used to get attention. Now, buyers want bigger savings—lower prices and better financing.

Holding Costs Are Eating Builders Alive

The Quiet Financial Pressure to Sell… Fast

Every unsold home costs money. Taxes. Utilities. Interest on loans. The longer a home sits, the more it eats into builder profits. That’s why price cuts are happening fast and often.

Cancellations and Cold Feet

Buyers Backing Out Is Sending Builders Into Damage Control

Buyers are canceling contracts. Some walk away from deposits. Others wait for bigger deals. Builders respond by lowering prices even more.

Where in Florida Are the Price Cuts the Deepest?

A Region-by-Region Breakdown of Who’s Slashing the Most

Areas hit hardest by price drops include:

- Tampa Bay

- Orlando

- Southwest Florida

These areas had the most aggressive building during the boom. Now, they’re dealing with the largest inventory and the steepest cuts.

Are Builders Competing With Each Other?

Yes—And the Rivalry Is Driving Prices Even Lower

It’s builder vs. builder. One lowers their prices, the others follow. Nobody wants to be the most expensive house on the block. The race to the bottom is on.

The Investor Factor

Why Fewer Investor Purchases Are Making a Big Difference

Investors used to scoop up new builds. Now, many are holding back or selling off. Without investor demand, builders have to rely more on cautious everyday buyers.

What This Means for New Construction Quality

Are Builders Cutting Corners to Cut Costs Too?

Some worry that steep discounts mean lower quality. That can happen if builders rush or use cheaper materials. Always ask:

- What warranties are included?

- Who handles repairs?

- Are materials up to code?

Is This a Correction or Something Bigger?

Experts Weigh In on Whether This Is a Short-Term Dip or Long-Term Shift

Some say it’s just a reset after the pandemic boom. Others warn that prices could fall further if inflation stays high and rates don’t improve.

What Homebuyers Should Know Right Now

Timing, Negotiating, and Spotting a Deal Worth Jumping On

Here’s what to do:

- Compare builders and offers

- Ask for upgrades or closing help

- Be clear on what you can afford

- Get a home inspection, even on new builds

How to Negotiate With Builders in This Market

Tips to Save Thousands and Get More for Your Money

Negotiation isn’t rude—it’s expected. Ask for:

- Price reductions

- Design center credits

- Landscaping or appliance upgrades

- Builder-paid interest rate buydowns

What Sellers Should Look Out For

Why Builder Price Cuts Could Affect Your Home’s Value

If a builder is offering a brand-new home nearby for less, your resale might suffer. Appraisals can also be impacted.

Strategies for Standing Out When Competing With New Construction

- Stage your home to shine

- Offer flexible showings

- Highlight upgrades and mature landscaping

How to Price Your Home Wisely in a Shifting Market

- Review recent sales

- Work with an agent who knows the area

- Price to attract buyers, not to test the market

When to Consider Updating, Staging, or Waiting It Out

- Make minor upgrades that pack a punch

- If you’re not in a rush, monitor the market before listing

What It Means for Florida’s Resale Market

Is Your Neighborhood Losing Value—or Staying Strong?

Established areas with amenities and strong demand are faring better. But neighborhoods near large new construction zones may feel more pressure.

Red Flags for Buyers and Sellers to Watch

What to Avoid When Builders Start Getting Desperate

- Too-good-to-be-true pricing

- Missing warranties

- Poor construction quality

- High HOA fees added later

Could Prices Drop Even More?

Why Some Experts Say the Bottom May Not Be Here Yet

If interest rates stay high and inventory keeps growing, more price cuts could come. But trying to time the bottom is tricky. Focus on what works for your goals.

What Builders Are Saying Behind the Scenes

Sneak Peek Into the Mindset of Developers Under Pressure

Privately, many builders are worried. They’re cutting prices, adjusting plans, and trying to avoid deeper losses. It’s a balancing act between staying competitive and staying profitable.

Will Florida Stay Affordable Long-Term?

What the Current Shift Means for Future Homebuyers

This may be a rare moment when buyers have the upper hand. But if inflation drops and demand returns, prices could rise again. Now might be your best shot.

Conclusion

The Bottom Line on Builder Price Cuts in Florida

Florida’s market is changing fast. Builders are reacting, and so should buyers and sellers. These price cuts aren’t panic—they’re a pivot. The key is to stay informed and be ready to act.

Call to Action

Thinking about buying or selling in Florida? The market is shifting, but the opportunity is real. Talk to a local expert, get the facts, and make the move when the timing feels right for you.

Want more insights like this? Subscribe or follow along for weekly updates on Florida real estate trends.